The information below was prepared and researched by Burleton Education with the assistance of ChatGPT Pro 5.2 and edited for accuracy.

In practice, most managed-care insurers do not write “gender-affirming care is excluded” outright. Instead, they cover a defined subset of gender-affirming services only when their “medical necessity” criteria are met, and they treat everything else as “not medically necessary/not covered” (often labeling it cosmetic, experimental, or contract-excluded).

Question:

“Is it ethically acceptable for an insurance provider to require a patient to commit to future gender-affirming surgery as a condition of receiving a non-surgical gender-affirming treatment (e.g., hormone therapy, puberty suppression, voice therapy, hair removal, supportive counseling, etc.)?”

Answer:

No.

Conditioning a non-surgical intervention on commitment to surgery undermines patient autonomy by introducing undue influence. Ethical informed consent requires that choices be voluntary and aligned with the patient’s values/goals. When access to needed care depends on agreeing to another, more invasive intervention, the patient’s decision-making becomes structurally constrained rather than genuinely self-directed.

Beneficence

Non-surgical gender-affirming treatments can be clinically appropriate and beneficial independent of surgery. Requiring a surgical commitment risks denying an indicated treatment that may alleviate distress, improve functioning, and support health.

It also may reduce trust and engagement with care.

Nonmaleficence (avoiding harm)

This requirement can cause harm by:

The practice introduces preventable harms without clear medical necessity. In effect, this creates a barrier that disproportionately affects:

patients who do not desire surgery.

patients unsure about surgery.

patients facing financial/medical/access barriers, and

patients seeking partial or individualized gender affirmation.

Ethically, access to medically indicated care should not be restricted based on a preferred “trajectory” of gender transition.

The practice raises justice concerns and functions as gatekeeping.

If you have already received a diagnosis of Gender Dysphoria or started HRT before buying an individual policy, the insurer may classify the entire transition as a pre-existing condition and exclude it entirely.

“CPB” stands for Clinical Policy Bulletin (or Coverage Policy Bulletin), which is an insurer-issued periodical update on changes to, or clarification of what is considered medically necessary care, and what the criteria is for accessing that care.

An insurer “Table of Benefits” defines the care that is covered under your plan, where you can access that care, and what limits/prior-authorization requirements exist related to that care.

If you are evaluating an international plan, check the “General Exclusions” section for these specific terms:

When speaking with an insurance broker about international plans, be direct and assertive. General questions about “LGBTQ+ friendly” plans often lead to vague answers. You need to ask for specific legal and clinical definitions in the policy.

Here is a checklist of high-value questions and strategies to ensure you get clear answers.

Many international brokers will say a plan “covers surgery” without mentioning it excludes gender-related ones.

Ask this first:

“Does this plan have any categorical exclusions for treatment, surgery, or medication related to ‘gender reassignment,’ ‘gender identity,’ or ‘sex transformation’?”

International plans often have their own definitions of “medical necessity” that may not match WPATH.

Ask:

“What clinical standard does the insurer use to determine if gender-affirming care is medically necessary? Does the plan strictly follow the WPATH Standards of Care (SOC 8)?”

“Gender reassignment surgery” in an insurance contract sometimes only means genital surgery.

If you need other care, ask:

If you are getting this plan through an employer, the rules are different.

Ask your broker:

“Is the gender-affirming care benefit part of the standard policy wording, or is it an optional rider? If it’s a rider, are there separate lifetime or annual financial caps for these services?”

Brokers often make verbal promises that don’t hold up during a claim. Use this strategy to get proof:

If your broker says any of the following, the plan likely does not provide the coverage you need:

When contacting an insurance broker or HR about international health insurance (IPMI), you need to get them to look beyond the “Summary of Benefits” and check the Clinical Policy Bulletins or the full Certificate of Insurance.

Below is a professional email template designed to pin down whether a plan has hidden exclusions for gender-affirming care (GAC).

Don’t forget to check out the “Pro Tips” at the bottom of the next column.

Subject: Inquiry regarding specialized coverage and clinical policy for Gender-Affirming Care

Dear [Broker/HR Representative Name],

I am evaluating [Plan Name] for my international health coverage. To ensure this policy meets my medical needs, I require clarification on the plan’s specific clinical policies regarding the treatment of Gender Dysphoria and Gender-Affirming Care (GAC).

Standard “Summary of Benefits” often lack the detail necessary to distinguish between reconstructive and cosmetic procedures for transgender members. Could you please provide the following information:

Hormone Replacement Therapy (HRT):

Is HRT covered under the outpatient pharmacy benefit, and are related laboratory services (such as blood monitoring) covered as standard medical care?

Benefit Riders:

If these services are not included in the core plan, is there a “Gender Affirmation Rider” available for purchase? If so, what is the lifetime financial cap for that rider?

Please provide the Clinical Policy Bulletin or the “Medical Necessity Guidelines” document specific to Transgender Health for this carrier so that I may review the exact requirements for prior authorization.

Thank you for your assistance in ensuring this plan provides comprehensive, ethical, and non-discriminatory care.

Sincerely,

[Your Name]

[Your Contact Information]

Pro-Tips for the 2026 Landscape:

Generally follows the clinical policies of Aetna U.S., which recognizes gender-affirming surgery as medically necessary. They are a common choice for multinational companies seeking to offer consistent benefits to transgender employees worldwide. Aetna generally has the most robust coverage because they align their international clinical policies with their U.S. standards (WPATH-based).

Medically Necessary (Covered):

2026 Shift: Aetna has issued a “Sex-Trait Modification Services” update for 2026. While they have removed coverage for federal employees (FEHB) due to new U.S. executive orders, their private international plans (Pioneer) still maintain coverage based on medical necessity

Clinical Requirements: Aetna requires:

One letter from a mental health professional.

Documented “marked and sustained” gender dysphoria.

12 months of hormone therapy for most genital surgeries (though only 6 months for breast surgery).

Age Limits: As of 2026, many Aetna international plans now restrict surgical coverage to those 18 and older, even in regions where it was previously allowed for younger ages.

Some Allianz Care health plans explicitly include coverage for gender-affirming surgery (often archaically described as “gender reassignment surgery”) if you meet plan criteria for gender dysphoria services. However, other Allianz Care plans may exclude “care and/or treatment or services for gender dysphoria” unless your plan includes a specific benefit/rider. Coverage is plan-dependent and criteria-driven, and is not automatic across all plans or countries.

Often lists “Gender reassignment” under their general exclusions unless it is specifically added as an optional rider or included in a high-tier corporate group plan.

Allianz Care’s Summit Employee Benefit Guide (2025) contains a dedicated “Gender-affirming care” section (ppg 45-47) describing coverage for medically necessary treatments and services for gender dysphoria, subject to local laws and regulations.

Pre-authorisation is very likely for surgeries / high-cost care

Allianz Care explains that your Table of Benefits indicates whether pre-authorisation is required, and that pre-authorisation is typically tied to in-patient and other high-cost treatments.

Practically:

If you pursue surgery (or anything treated as high-cost), assume you’ll need pre-authorisation.

If you skip it, you can end up declined for Missing Pre-authorization (MPA).

Many of their standard international private medical insurance (IPMI) contracts historically exclude gender-affirming surgery, categorizing it as “cosmetic” or “lifestyle” treatment, though they often cover mental health support for gender dysphoria.

Bupa historically had the strictest exclusions, but they have modernized their 2026 corporate offerings.

Individual Plans: Most individual Bupa Global plans (like Major Medical or Select) still list gender reassignment as a categorical exclusion.

Corporate Plans: For large companies, Bupa offers a “Gender Affirmation” rider. This is generally a lifetime financial cap (e.g., £50,000 or $100,000), which is different from most U.S. plans that have no cap.

Common Exclusions: Bupa often excludes “cosmetic” feminization, such as facial bone remodeling or hair transplants, even if the plan covers genital surgery.

Finding A Surgeon

Bupa typically does not list “surgeons”; they list “hospitals.” If your Bupa plan has the GAC rider, you must choose a hospital in their Elite or Premium network.

One of the more progressive international options. They frequently offer coverage for gender reassignment surgery and hormone therapy as part of their “Platinum” tier plans or custom corporate packages. However, they still require strict adherence to medical necessity criteria (similar to WPATH standards).

While Cigna is one of the most transparent international carriers regarding gender-affirming care (using a “reconstructive” vs. “cosmetic” framework), their coverage is split between their “Global” (expat) side and their “State-regulated” side.

The Exclusion: In many standard individual Cigna Global policies, you will still find Exclusion #43: “Procedures, surgery or treatments to change characteristics of the body to those of the opposite sex unless such services are deemed Medically Necessary or otherwise meet applicable coverage requirements.”

The “Platinum” Exception: On high-tier Platinum plans or corporate group plans, the above exclusion is often waived.

Covered (if not excluded):

Finding A Surgeon

Cigna has upgraded its directory for 2026. Instead of a separate PDF, they now allow doctors to “self-identify” as GAC specialists.

Note: Reversal of gender affirmation procedures is almost universally excluded.

Important Framing:

For international insurers, GAC coverage is almost always a two-step test:

Clinical Policy Benefits (CPB)/medical necessity criteria (what’s eligible), and

Your Table of Benefits (ToB)/Certificate (what your plan actually pays for, where, and with what limits).

Important “In-Network” Warning for 2026

Even if a surgeon is “in-network,” you must obtain Pre-Certification (also called Prior Authorization) before the surgery.

Below is a pediatric-focused summary of gender-affirming care (GAC) benefit categories insurers may cover when the benefit is included in the member’s Table of Benefits (ToB) and when pre-authorization/medical-necessity criteria are met.

Below is a practical “how to read them together” comparison of the Clinical Policy Bulletin/Coverage Policy (CPB) versus the Table of Benefits (ToB) for international gender-affirming care (GAC) across Aetna, Allianz Care, Bupa Global, Bupa Global (Elite/Premium), and Cigna Global managed care plans.

Important “In-Network” Warning for 2026

Even if a surgeon is “in-network,” you must obtain Pre-Certification (also called Prior Authorization) before the surgery.

When you’re building a pre-authorization packet for international GAC, use this structure:

Even when you clearly meet CPB/policy criteria, international GAC gets denied most often due to ToB mechanics such as:

Geographic area of cover (Worldwide vs excluding U.S., etc.).

Pre-authorisation requirement (common for surgery and for Bupa’s gender dysphoria benefit specifically).

Provider eligibility rules (recognized facility/provider requirements).

Benefit categorization (whether GAC must be billed under a special benefit line vs “general surgery”).

Exclusions + special conditions (especially with older/legacy wording (“sex reassignment surgery” or “gender reassignment surgery).

“Benefit exists, but criteria not met → Not medically necessary → Not covered.”

“Procedure classified as cosmetic (or convenience) → Not medically necessary → Not covered.”

“Contract limitation (especially self-funded employer plan) → excluded regardless of medical necessity.”

The highest-volume “medical necessity” denial targets tend to be things like facial procedures, hair removal, body contouring, voice procedures, and other services the plan frames as cosmetic unless strict criteria are met (and they are documented exactly as required).

Even if a plan does not have a “transgender exclusion,” many international plans have very broad cosmetic surgery exclusions.

The Conflict: Procedures like facial feminization (FFS) or chest contouring are often denied by international carriers on the grounds that they “beautify” rather than “restore function.”

Inland (U.S.-based) vs. International: While a California-regulated plan must view FFS as “reconstructive,” an international plan based in Dubai or the UK is not bound by California’s definition and can legally deny the claim as cosmetic.

The “Area of Cover” on your international plan matters.

Middle East & SE Asia: Policies issued in countries where gender-affirming care is restricted or illegal often contain mandatory exclusions to comply with local laws.

European Heritage: Plans headquartered in the UK or France are more likely to cover hormone therapy and mental health, but may have long waiting periods or high deductibles for surgeries.

These narratives can be copy/pasted to file a complaint, grievance, or appeal to your insurance provider in the event you’ve been denied coverage of a non-surgical gender-affirming care procedure because it must be tied to plans to pursue a surgical procedure in the future.

Template A:

Direct and concise, in plain language.

Template B

More formal and detailed; “policy ready”.

I am filing a grievance because I was told I must commit to future gender-affirming surgery to overcome a “not medically necessary” exclusion for coverage of the non-surgical gender-affirming care treatment I requested. I do not want to be pressured into surgery to receive medically appropriate non-surgical care.

Requiring a surgical commitment as a condition of non-surgical care is coercive, not clinically necessary, and interferes with my ability to make voluntary, informed decisions about my healthcare. Non-surgical gender-affirming care can be appropriate whether or not surgery is desired, and care should be based on my current medical needs and informed consent—not on agreeing to a particular transition pathway.

I am requesting:

Access to the requested non-surgical gender-affirming care without any requirement to commit to surgery,

A written explanation of the clinical rationale for the denial/condition, and

Confirmation that future care will be provided based on individualized medical assessment and informed consent rather than on a coupled requirement to pursue surgery.

I am submitting this grievance regarding an inappropriate exclusion placed on my access to care. I requested non-surgical gender-affirming care (e.g., [hormone therapy/voice therapy/hair removal/other non-surgical treatment]).

I was informed that, due to a “not medically necessary” gender-affirming care exclusion, I would be unable to access coverage for this non-surgical treatment unless it was coupled with a commitment to pursuing gender-affirming surgery (now or in the future).

This requirement is problematic for several reasons:

Coercion/lack of voluntary consent: Conditioning one form of care on agreement to a different, more invasive intervention undermines voluntary decision-making and informed consent. It creates undue pressure to declare interest in surgery even if surgery is not desired or if I am not ready.

Medical inappropriateness: A commitment to surgery is not a clinically necessary prerequisite for receiving non-surgical gender-affirming treatment. The appropriateness of non-surgical care should be assessed based on its own indications, risks/benefits, and patient goals—not on a mandated “transition trajectory.”

Harm and barriers to care: This condition increases distress, delays medically indicated treatment, and may force patients into misrepresenting their goals to access care. It also disproportionately burdens individuals who do not want surgery or cannot access surgery due to medical, financial, or logistical barriers.

I am requesting the following resolutions:

Immediate access to the non-surgical gender-affirming care I requested without being required to commit to surgery.

A written explanation of the rationale for the condition placed on my care and identification of any policy relied upon.

Review and correction of any clinic/department policy or practice that conditions non-surgical gender-affirming care on a surgical commitment.

Assurance that my care will proceed using an individualized, patient-centered informed consent approach consistent with ethical standards.

“I am not refusing or requesting surgery. I am requesting medically appropriate non-surgical care based on my current goals and informed consent. My eligibility for non-surgical treatment should not be determined by whether I intend to pursue a separate surgical intervention.”

This provider-support letter template is designed to be persuasive across Aetna, Cigna, and Bupa Global insurers. It is written in clinical/utilization-review language, focuses on medical necessity + individualized care + decoupling non-surgical care from surgical intent, and avoids overreaching claims.

It can be pasted into a clinic letterhead format. [Bracketed] fields are placeholders.

[Clinic/Medical Group Letterhead]

[Date]

RE: Medical Necessity / Clinical Support for [Non-surgical gender-affirming service]

Patient: [Full Name]

DOB: [MM/DD/YYYY]

Member ID / CIN: [If applicable]

Plan: [Aetna / Cigna / Bupa Global / Other]

Provider: [Name, Credentials]

NPI: [#]

Address / Phone / Fax: [Contact info]

To Whom It May Concern,

I am [treating clinician / prescribing clinician / supervising clinician] for [Patient Name], whom I have evaluated and/or treated in my clinical practice. I am writing to provide clinical support for [requested non-surgical gender-affirming care service] and to clarify that access to this non-surgical treatment should not be conditioned on any commitment to future gender-affirming surgery.

I am requesting authorization/coverage for:

Service: [e.g., gender-affirming hormone therapy / puberty suppression / voice therapy / hair removal / behavioral health support / other]

Dose/Frequency/Duration (if applicable): [details]

CPT/HCPCS (if known): [code(s)]

Diagnoses/Clinical indications: [e.g., gender dysphoria / gender incongruence / related symptoms, as clinically appropriate]

Treating Provider(s): [names/roles]

Based on my clinical assessment, [requested service] is medically appropriate and necessary for this patient’s current needs and goals. This non-surgical treatment is indicated to address:

clinically significant distress and/or functional impairment related to gender incongruence/dysphoria and/or associated symptoms; and

the patient’s individualized treatment goals, which may include partial or non-surgical gender affirmation.

This is a standard, evidence-informed intervention used to improve patient well-being and reduce distress. It is not investigational or elective in the sense of being optional to health; rather, it is a medically appropriate component of care when clinically indicated.

It is clinically and ethically inappropriate to require a patient to “commit” to future gender-affirming surgery as a prerequisite for receiving non-surgical gender-affirming care.

Whether a patient desires surgery:

is separate from whether non-surgical care is medically appropriate;

may change over time as a patient evaluates options; and

should be determined through shared decision-making, not used as a gatekeeping condition for access to clinically indicated non-surgical treatment.

In my medical opinion, conditioning non-surgical care on an expressed intent to pursue surgery is not medically necessary, does not improve safety, and may cause harm by delaying needed treatment and undermining informed consent.

This patient is appropriate for non-surgical treatment under a patient-centered informed consent model with appropriate monitoring.

Our plan includes:

discussion of expected effects, potential risks/benefits, alternatives, and the option of no treatment;

baseline assessment and follow-up monitoring consistent with standard clinical practice;

management of any relevant comorbidities and safety considerations; and

ongoing evaluation of goals and outcomes over time.

This approach is proportionate, safe, and clinically appropriate. It does not require an intent to pursue surgery.

I respectfully request that [Plan/IPA/UM Department] approve [requested service] based on individualized clinical need and medical necessity. Please confirm that authorization/coverage is not contingent upon the patient’s stated interest in future surgical procedures.

If coverage is denied or limited, please provide:

the specific criteria/policy relied upon,

the clinical rationale linking non-surgical eligibility to surgical intent, and

information regarding the appeal process and external review options.

Thank you for your prompt attention to this request.

Sincerely,

[Provider Name, Credentials]

[Title / Specialty]

NPI: [#]

License #: [#]

Phone: [#]

Fax: [#]

Email (optional): [#]

Attachments (optional):

[Relevant clinical notes/assessment summary]

[Labs/monitoring plan]

[Prior treatment history]

“The patient’s treatment goals are individualized and do not require a predetermined pathway or a commitment to surgery. Non-surgical gender-affirming care is a medically appropriate endpoint for many patients and should be accessible based on current clinical need.”

“Delay in treatment is likely to worsen symptoms and increase distress. I am requesting expedited review and timely access to medically necessary care.”

“There are no clinical contraindications requiring delay at this time. The patient is appropriate for initiation/continuation of non-surgical gender-affirming care with standard monitoring.”

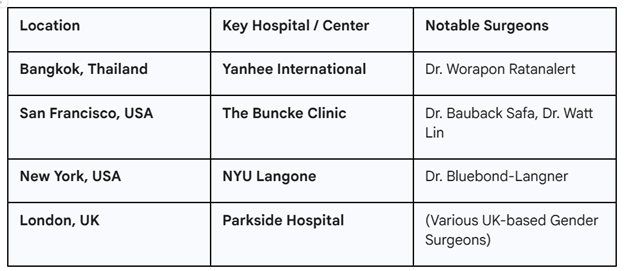

If you are traveling for care, these three locations are the “Gold Standard” where Aetna, Cigna, and Bupa almost always have direct-pay agreements: